The Maine Education Association and the National Education Association advocated for an overhaul of the broken Public Service Loan Forgiveness (PSLF) program. We have been heard: The US Department of Education has announced temporary overhauls that are already saving members tens of thousands of dollars. Continue reading to see if you can save too!

On October 6, 2021, the U.S. Department of Education announced major changes to the Public Service Loan Forgiveness (PSLF) program.

The new changes might help you if:

• You have federal student loans AND you work full-time for a school district, or institution of higher

education

AND

• You have Direct Loans OR You consolidate into the Direct Loan Program by Oct. 31, 2022

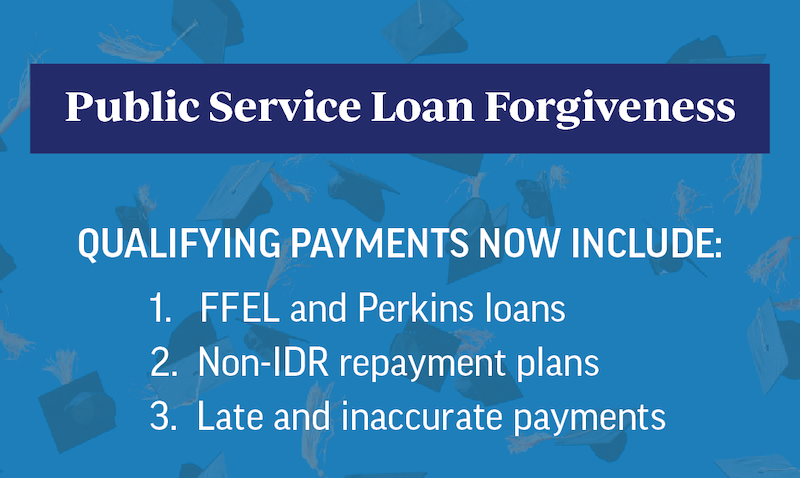

| Previous Rules | Temporary Changes |

| Borrowers who have Federal Family Education Loans (FFEL) or Perkins loans were ineligible for forgiveness | FFEL and Perkins loans payments are now eligible and count towards the required 120 payments |

| Payments in non-income driven repayment plans did not count towards the required 120 payments | Previous payments outside of income-driven repayment now count towards the required 120 payments |

| Previous late payments were not credited toward the required 120 payments | Previous late payments and partial payments now count towards the required 120 payments |

| Previous late payments and partial payments now count towards the required 120 payments | Payments made prior to consolidation will now be eligible towards the required 120 payments |

What public servicer workers need to do before October 31, 2022:

- Go to studentaid.gov/pslf, login with your Federal Student Aid ID (or create one if you do not have one)

and make sure your contact information is up to date so the U.S. Department of Education can

communicate directly with you. - If you have a Direct Loan, have made 120 payments, and have applied for PSLF, you should receive

automatic forgiveness soon. - If you have a Direct Loan, have made 120 payments, and have NOT applied for PSLF, you need to apply

for PSLF right away. - If you have a FFEL or Perkins loan, you need to consolidate into a Direct Loan, then apply for PSLF.

Why did the PSLF program change?

PSLF was created in 2007 to forgive the federal student debt of public employees, including teachers, faculty,

and education support professionals, who provide 10 years of service and make 120 monthly payments on their

student loans.

However, when the first borrowers became eligible for forgiveness, the Trump Administration prioritized profits

for big banks over keeping the promise of PSLF. They denied over 90 percent of applications and kept public

service workers paying interest on debts that should have been canceled.

Loan forgiveness was denied because the program had too many technicalities and many loan servicers misled

borrowers about the rules. The Biden Administration’s overhaul fixes some of the technicalities and will mean

debt forgiveness right away for tens of thousands of public service workers and eventual forgiveness for many

more. Eventually, hundreds of thousands of educators could become eligible for loan forgiveness over the next

year.

10 years of public service equals no student debt. That is the promise. And we will not stop until that promise is

kept to everyone.

The changes to PSLF will exist only until October 31, 2022.

For more information, go to studentaid.gov/announcements-events/pslf-limited-waiver.

Need Help?

You can apply for PSLF forgiveness at studentaid.gov/pslf.

And every MEA/NEA member can get free help applying for PSLF (and with any questions about student debt) by going to neamb.com/Savi.

If you are not a member of MEA, you can join by going to mea.org/join.