News, President's Message

The season of graduation and end-of-year celebrations and state championship games is upon us—along with (thankfully) warmer weather. But amidst everything you do, please take a few moments between all these events and activities to read on for interesting and...

Conferences & Seminars, News, Professional Development

The countdown to summer is on, and MEA is calling on all adventurers to join us at MEA Summer Camp – Our 2 Day Summer Conference! LEARN MORE MEA Summer Camp offers the perfect FREE opportunity for members to connect with union colleagues from across the...

News, Read Across America

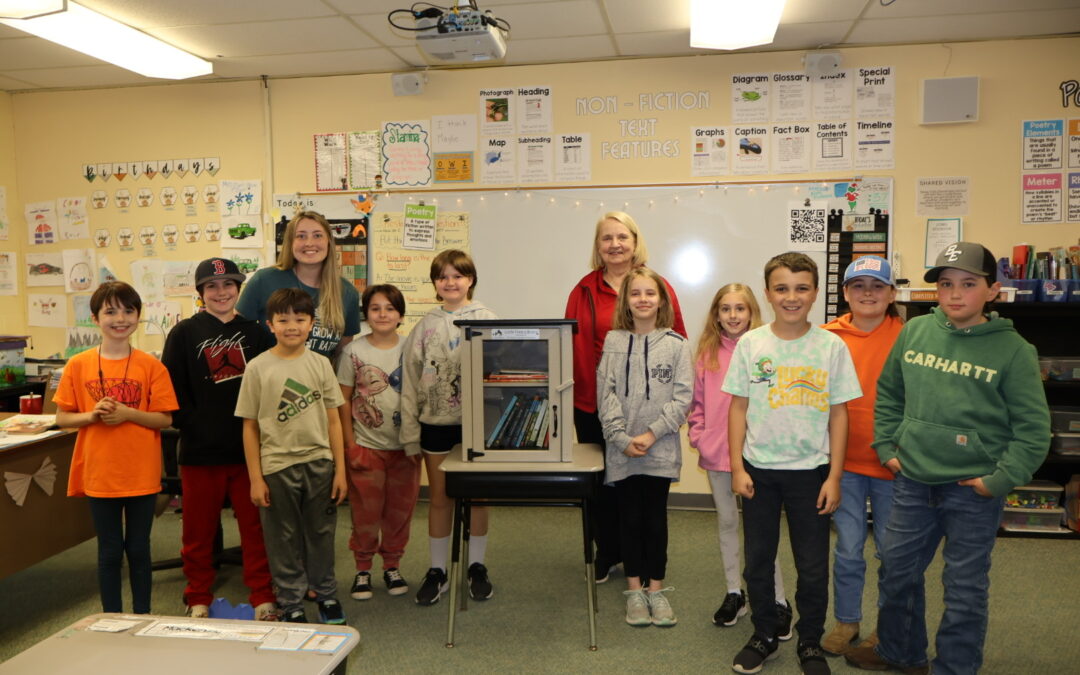

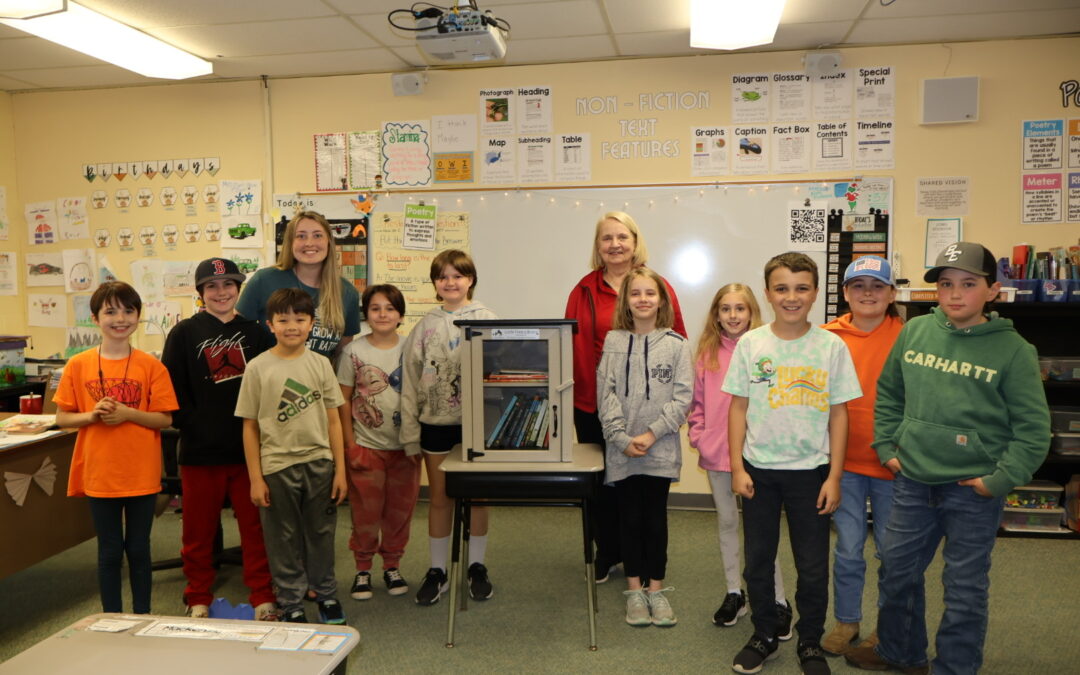

STEEP FALLS, MAINE – May 9, 2024 ‐ On Thursday, Ashley Cram’s fourth-grade students were presented with a Little Free Library by Grace Leavitt, President of the Maine Education Association (MEA), for their success in the Read Across Maine Contest. Read Across...

News, President's Message

It seems that one can just about always say, ‘This is a busy time of year”, but I’m sure that is especially true in the month of May. At MEA, with the legislature having adjourned, our focus turns to the upcoming MEA Representative Assembly, the NEA Representative...

Conferences & Seminars, News, Professional Development

As you prepare for the end of the school year, we invite you to save the dates for your Union’s summer conference – MEA Summer Camp. Details When: Monday, July 29th and Tuesday, July 30th Where: University of Southern Maine Campus – Portland, Maine Cost: Free...